Recent trends in South Australian manufacturing

The Australian Bureau of Statistics publishes annual estimates of the economic and financial performance of South Australian manufacturing as part of its Australian Industry series. The 2017/18 data, published at the end of May, provide insight into how various sectors within manufacturing have performed over recent years. These data probably give a better indication of trends at the manufacturing subdivision level than estimates from the Labour Force Survey.

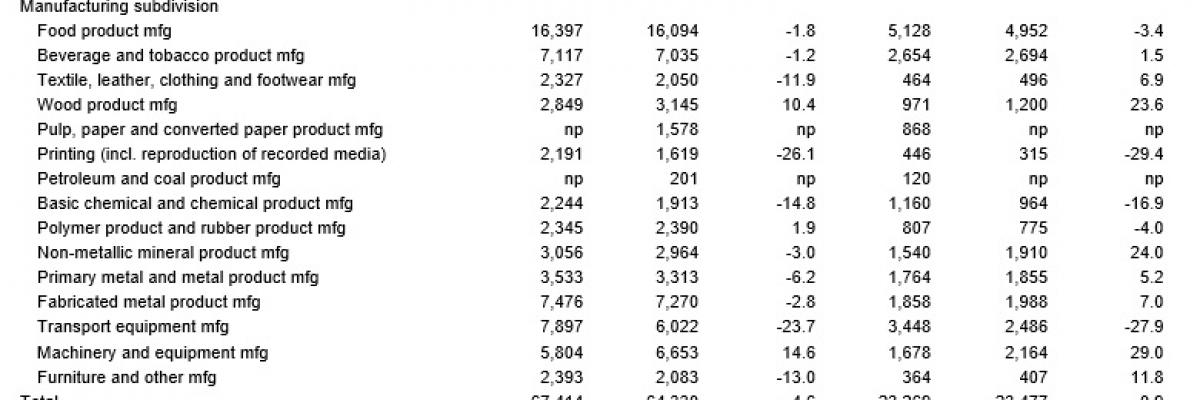

The table below shows estimates of employment and sales and service incomes by manufacturing subdivision for South Australia in 2014/15 and 2017/18.

The South Australian manufacturing industry is to a substantial extent involved in the transformation of agricultural output into food products, wine, leather, etc. Food product manufacturing was the single largest employing sector at the end of June 2018, accounting for one quarter of total manufacturing employment, while beverage and tobacco product manufacturing accounted for a further 11 per cent of total employment. The production of machinery and equipment also remains significant, with machinery and equipment manufacturing accounting for 10 per cent of employment and transport equipment manufacturing accounting for a further 9.4 per cent. Fabricated metal product manufacturing accounted for 11 per cent of employment, with its products going both to exports and to a range of downstream sectors in South Australia such as machinery and equipment, transport equipment and construction. Primary metal and metal product manufacturing, which includes the smelting activities at BHP‘s Roxby Downs operations and Nyrstar’s Port Pirie plant, accounted for a further 5 per cent.

Employment and Sales and Service Income by Manufacturing Subdivision

South Australia, 2014/15 and 2017/18

The South Australian manufacturing sector has shrunk over recent years. Total manufacturing employment at the end of June 2018 was down 5 per cent from its level 3 years earlier. While sales and service income did rise by 1 per cent between 2014/15 and 2017/18, this small rise was in current price terms, which suggests that in real terms manufacturing income fell over the period.¹

Manufacturing employment has also shown quite weak trends at the national level. Total national manufacturing employment fell by 2 per cent over the three years to 2017/18, while sales and service income rose by 2 per cent.

One of the most notable structural changes in the South Australian economy over recent years has been the decline and then the closure of local passenger vehicle manufacturing. The impact of the closure can be seen in the data, with transport equipment manufacturing recording the largest aggregate decrease in employment over the three years to June 2018 (down 1,875 persons / 24 per cent). But employment levels also fell in most other manufacturing subdivisions over this period. There were relatively large falls for printing (down 572 persons / 26 per cent), basic chemical and chemical product manufacturing (down 331 persons / 15 per cent), furniture and other manufacturing (down 310 persons / 13 per cent), and textile, leather, clothing and footwear manufacturing (down 277 persons / 12 per cent). There were increases in employment for machinery and equipment manufacturing (up 849 persons / 15 per cent), wood product manufacturing (up 296 persons / 10 per cent), and polymer product and rubber product manufacturing (up 45 persons / 2 per cent).

June 2019 Economic Briefing and Luncheon

The above excerpt is taken from the Centre’s upcoming June Economic Briefing Report, which will be launched at a presentation and luncheon to be held at The Intercontinental Adelaide on Wednesday 3 July 2019 (from 12:00 noon).

The function includes a presentation on the situation and outlook for the South Australian economy, presented by Steve Whetton, Deputy Director, SA Centre for Economic Studies.

Our guest speaker is Dr Matthew Butlin, Chair and Chief Executive of the South Australian Productivity Commission. The title of his presentation is Productivity, Growth and Reform.

The Economic Briefing Report and Briefing Luncheon are two of the benefits provided to corporate members as part of the Centre’s Corporate Membership Program.

Notes: ¹ State Accounts data support this contention: real terms manufacturing value added fell by 11 per cent between 2014/15 and 2017/18.