ThincAngel

Develop the key knowledge and skills to start angel investing.

What is ThincAngel?

ThincAngel is an immersive short course that will give you the essential skills needed to navigate the world of investing in early-stage companies.

Through a practical curriculum and hands-on approach, this course guides you through the intricacies of angel investing from start to finish. You'll delve into the process of identifying and evaluating tech-based ideas, assessing their potential, and devising strategic approaches to assisting the founders to turn them into successful ventures.

Download the information pack here.

The program

- Introduction to Angel Investing

- Startup Evaluation

- Investment Processes

- Mitigate Risks

- Investment Strategies

- Legals and Governance

- Portfolio Management

- Network with Industry Leaders

Whether you're a high-net-worth individual, or simply passionate about innovation, ThincAngel offers a learning experience to help you make informed investment decisions, navigate risks, and build a purposeful and profitable investment portfolio to propel South Australia into the future.

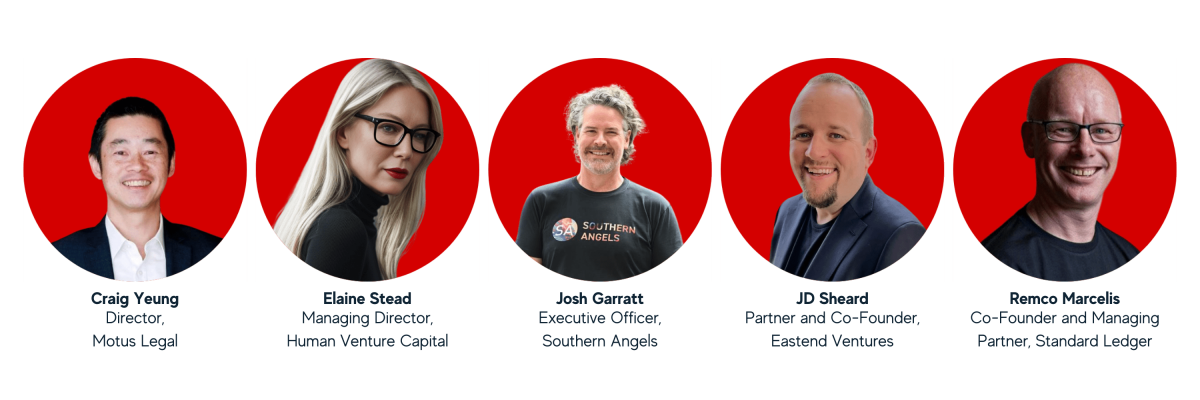

Your 2024 Industry Experts

Course outcomes

By the end of this course, you will emerge with a keen understanding of angel investing principles and practices. Armed with valuable insights from seasoned investors, you'll gain the ability to make informed investment decisions, navigate risks, and build a purposeful and profitable investment portfolio.

- Investment Evaluation: Acquire the knowledge and techniques to identify promising startups, evaluate their market potential, and assess their investment attractiveness.

- Mitigate Risks: Develop the skills to conduct thorough due diligence, assess financial viability, and mitigate risks associated with early-stage investments.

- Investment Strategies: Learn about favourable investment terms, structure deals, and create a well-rounded investment strategy that aligns with your goals.

- Build a Diversified Portfolio: Learn how to attract strong deal flow and understand the importance of a diverse and balanced investment portfolio.

- Network with Industry Leaders: Connect with experienced investors, and establish valuable relationships within the angel investment ecosystem.

Our partner

The University of Adelaide and Southern Angels' network of investors offer real-world insights, providing you with unparalleled guidance throughout the course. Join a vibrant community of like-minded individuals, foster meaningful connections and potential collaboration in the angel investment ecosystem.Are you eager to tap into the opportunities of angel investing?