SA small businesses bearing costs of late payments by big business

Small and Medium Sized Enterprises (SME) play an important role in the South Australian economy and employment, accounting for 44 per cent of SA employment. The commercial and financial health of SMEs is of particular importance to the growth and development of the SA economy. A critical aspect in this regard is that businesses get paid on time for the goods and services they supply.

In April this year, SACES, with support from the South Australian Business Community who fund the Independent Research Foundation (IRF), undertook a pilot survey of South Australian SMEs on payment terms, times and practices. As a pilot, this survey was limited to members of the Construction Industry Training Board (CITB) and Civil Contractors Federation in South Australia (CCFSA), was conducted online and asked about experiences of late payment.

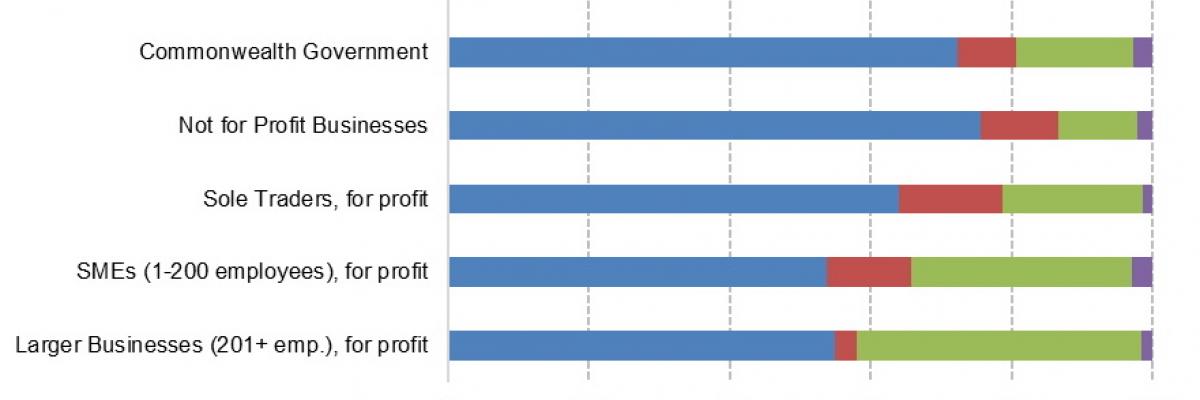

Respondent businesses and sole traders provided information about their Account terms and the extent to which their customers met those terms - see Figure 1, which shows compliance with Account terms by client type. Businesses came largely from the construction industry, but also included some operating in rental, hiring and real estate services; and professional, scientific and technical services.

The main messages from the survey were that, over the past twelve months:

- the majority (more than 60 per cent) typically received payment for good and services supplied within the period determined by the Account terms;

- Not for Profit businesses, sole traders and SMEs were most likely to meet Account terms (reported by 87 per cent, 79 per cent and 66 per cent of respondents, respectively);

- big businesses (200+ employees) were most likely to pay later than stipulated (40 per cent of respondents reporting typically late payment by these businesses); and

- the Federal, and SA State and Local Governments were typically paying on time (reported by 81 per cent, 77 per cent and 77 per cent of respondents, respectively);

- the reported costs of collecting late payments was as high as 20 per cent of the invoices being followed up.

Figure 1: Customer payment behaviours by client type

The survey highlighted continued concern amongst SMEs in South Australia about customers’ propensity to meet payment terms. As a pilot, the survey relied on a small number of businesses. A larger, more representative survey is intended for later this year. This is proposed to get an understanding of the overall costs and other impacts of late payments to small businesses and the South Australian economy in terms of potentially foregone business and industry growth and employment opportunities. These are particularly important and timely issues for analysis and understanding as the SA economy recovers from the COVID-19 shutdown.